China portside iron ore keeps premium to seaborne

The Argus PCX price for 62pc portside fines was at an average premium of 52¢/dry metric tonne (dmt) to the Argus ICX 62pc seaborne fines index average of $69.46/dmt in December, up from a 42¢/dmt premium in November. On an outright basis, both indexes fell from November as a sharp erosion in steel profit margins since mid-November moderated demand for premium medium-grade fines.

Among the portside brand prices assessed by Argus at Qingdao port, the premium for BRBF fines to the Argus PCX price contracted to 1.3pc above the PCX index last month, down from a 2.35pc premium in November. The BRBF fines premium to the PCX peaked in July at 11.92pc as demand for low-alumina fines spiked in China, but its premium steadily declined in the second half of 2018.

The premium for Newman fines to the PCX index rose to 1.81pc from 1.58pc in November, while Qingdao-traded PB fines narrowed its discount to 0.73pc from 0.84pc. Caofeidian-traded PB fines traded flat to the PCX price in November and December.

SSF fines narrowed its discount to the PCX price to 36pc in December from 38pc in November. Demand for low-grade ores has increased over the past month as mills seek to reduce costs by increasing the proportion of lower-cost ore in the burden.

The PCX price had traded at a discount to the ICX for most of 2018, turning to a premium in November. The seaborne-equivalent of the yuan-denominated PCX price is calculated by assuming a 16pc value-added tax and 8pc moisture.

But the ICX price has been at a premium to the PCX price on every trading day since 21 December as mills increase purchases of January-loading, February-delivered Australian mainstream, medium-grade fines to stock up for the lunar new year holiday in the second week of February and the resumption of full-scale construction work in north China in the spring.

Mills are unlikely to aggressively restock for February-March cargoes, with profit margins quite depleted and concerns about weak steel demand in the first quarter of 2019. Mills could reduce buying of both portside and seaborne ores in the near term if China tightens environmental restrictions on sintering and steelmaking because of worsening pollution. China's largest steel-producing city of Tangshan may extend strict sintering curbs, imposed until 31 December, which could reduce iron ore demand.

McFarlane Lake expands portfolio with $22M buy from Aris

Glencore to sell Philippine copper smelter to Villar family

Gold ETFs drew largest inflow in five years during first half of 2025, WGC says

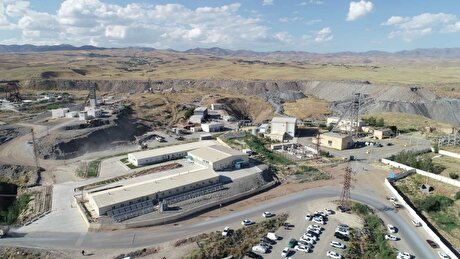

Navoi saw first half output value double on higher gold prices

Fatalities rise for second year in global mining sector

Copper output at Ivanhoe’s Congo mine jumps in second quarter

Copper mine output to rise 2.9% annually over next decade, says Fitch’s BMI

Taseko more than doubles value of Yellowhead project near Gibraltar

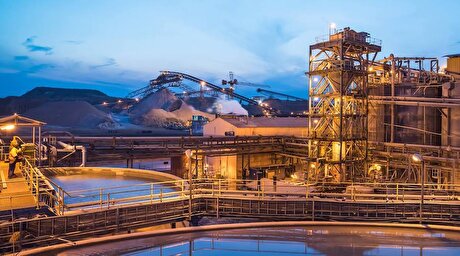

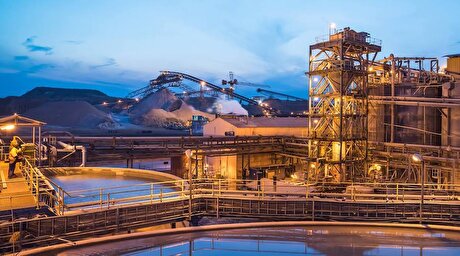

Smelter mishap stokes shutdown push at Codelco

Rinehart urges Rio Tinto to shift main office to Australia

Rio Tinto picks iron ore boss Simon Trott as new CEO

Gold price forecast gets 15% upgrade for 2025: LBMA poll

Apple invests $500M in Pentagon-backed MP Materials

Namib to spend up to $400M to restart Zimbabwe gold mines

Critical Metals soars as it begins drilling to boost Greenland rare earth resource

Trump’s 50% copper tariffs jolt US market as buyers slash imports and delay orders

Friedland backs Trump’s copper tariff as wake-up call

BHP to explore battery partnerships with CATL, BYD

Silver price surges to 14-year high amid mounting trade tensions

Rio Tinto picks iron ore boss Simon Trott as new CEO

Apple invests $500M in Pentagon-backed MP Materials

Namib to spend up to $400M to restart Zimbabwe gold mines

Trump’s 50% copper tariffs jolt US market as buyers slash imports and delay orders

BHP to explore battery partnerships with CATL, BYD

Silver price surges to 14-year high amid mounting trade tensions

CHART: Nvidia hits $4 trillion – how do mining stocks stack up?

Lockheed Martin reboots Pacific seabed mining plans

Alba kicks-off its Summer Safety & Health Campaign for 2025