High Inventories Likely to Keep Indian Billet Export Offers Under Pressure

The SteelMint further learnt that disparity is being created by some of the leading billet producers from India, which are trying to compete with Iranian billet. If sources to be believed, every prime billet manufacturer have given the impression that India is having surplus of billets over high inventories amid dull domestic demand and they can match the prices with Iranian billets. Current offers from Indian to SE Asia are reported to be USD 420-425/MT, CFR. While other majors are offering USD 430-435/MT, CFR.

Billet export offers from CIS witness a sharp drop- This week billet export assessment from CIS nations stands at USD 385-390/MT, FoB Black Sea, down USD 15 against last week. The market sentiments were reported weak in the region.

Vietnam billet offers - This week Vietnam’s domestic billet offers are at USD 450/MT, identical as last week. Amid lower prices in exports, mills were heard preferring billets in domestic market. The marketers believe, they cannot compete with Indian origin billets and hence focusing on the domestic market.

Turkey imported scrap prices fall further - The global ferrous scrap market has witnessed downtrend in almost all major markets this week. Turkey imported SCRAP prices at 2-years low. HMS (80:20) European origin at USD 270/t, CFR Turkey.

Northern Dynasty in talks to settle EPA litigation, shares hit 5-year high

Gold price retreats to one-week low on US tariff delay

China Rare Earth Group says executive moves at listed unit won’t affect operations

US couple could face trial over gold bars missing from 18th Century sunken ship

Royal Gold to acquire Sandstorm, Horizon in $3.7B deal

Lupaka Gold skyrockets on arbitration win against Peru

Torngat Metals’ rare earths project revival aims to create ‘a new industry in Canada’ CEO says

Mali to sell $107M in gold from Barrick to fund mine restart

Critical minerals to top Modi’s agenda in five-nation tour

Navoi saw first half output value double on higher gold prices

Fatalities rise for second year in global mining sector

Taseko more than doubles value of Yellowhead project near Gibraltar

McFarlane Lake expands portfolio with $22M buy from Aris

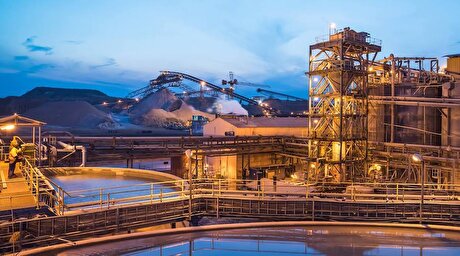

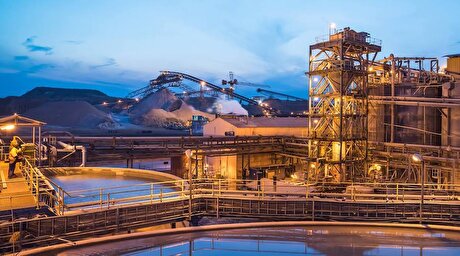

Smelter mishap stokes shutdown push at Codelco

Copper output at Ivanhoe’s Congo mine jumps in second quarter

Gold ETFs drew largest inflow in five years during first half of 2025, WGC says

Glencore to sell Philippine copper smelter to Villar family

Mali to sell $107M in gold from Barrick to fund mine restart

EU prepares to stockpile critical minerals in case of war: FT

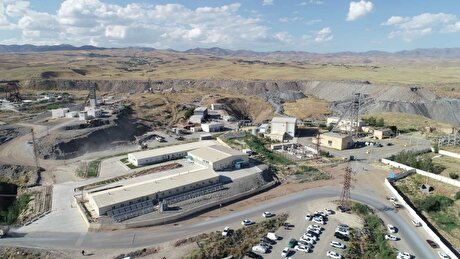

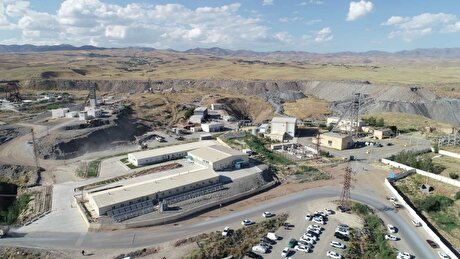

Navoi saw first half output value double on higher gold prices

Fatalities rise for second year in global mining sector

Taseko more than doubles value of Yellowhead project near Gibraltar

McFarlane Lake expands portfolio with $22M buy from Aris

Gold ETFs drew largest inflow in five years during first half of 2025, WGC says

Mali to sell $107M in gold from Barrick to fund mine restart

EU prepares to stockpile critical minerals in case of war: FT

Dundee receives environmental OK for underground gold project in Ecuador

China’s mining investment sets new record