Weak demand drags low-CV Indonesian coal prices lower

Market participants are still absorbing the price at which Chinese state-run utility Huaneng awarded a recent tender that included several geared Supramax cargoes of NAR 3,800 kcal/kg (GAR 4,200 kcal/kg) coal, at a price that equates to around $26.13/t on a fob Indonesia basis.

The demand outlook weakened further after India today extended a nationwide lockdown until 3 May in an attempt to curb the spread of Covid-19. Indian ports and coal transportation services were deemed essential services, but demand from many sectors in the country has been at a near standstill since the curbs were announced last month.

A number of late April-loading GAR 4,200 kcal/kg cargoes are still available, suggesting a well-supplied market. There are expectations that prices are likely to fall even further in the coming days, given the increasingly weak demand outlook. May-loading geared Supramax GAR 4,200 kcal/kg cargoes were bid today in a $27-28.50/t range and offered in a $29-30/t range, while April cargoes were bid and offered at similar levels. April-loading shipments fall outside the current 60-day May and June assessment window for inclusion in the Argus index.

Argus last assessed the spot GAR 4,200 kcal/kg market at $30.18/t on 9 April. Prices of this coal have declined by almost 11pc since January in response to a bearish outlook in major markets.

In the ICI 4 derivatives market, a 5,000t May clip traded on the CME at $28/t, while May futures were bid at $26/t and offered at $28/t. The last Argus settlement price for May was at $29.80/t yesterday.

In the Australian high-ash market, bids for May-loading Capesize cargoes of NAR 5,500 kcal/kg coal were in a wide $45-50/t range, while offers were in a $51-52/t range, down from $53/t yesterday.

The combined daily coal burn at the six main coastal utilities in China slipped to 506,200t/d on Monday from 536,600t/d on Sunday, equating to 32 days of coal burn. A fresh coronavirus outbreak has resulted in a lockdown in the northeastern Chinese city of Suifenhe located in Heilongjiang province. Mines could close, if the infections spread to the neighbouring coal producing province of Inner Mongolia, although the extent of the outbreak in the region is unclear.

Prices in the Chinese domestic spot market continued to retreat, with tradeable prices of NAR 5,500 kcal/kg coal at round 488-492 yuan/t fob north China ports.

In China's futures market, the May contract in the Zhengzhou commodity exchange closed at Yn462/t, down from Yn478.20/t yesterday. The main September contract closed at Yn479.80/t, down from Yn488/t yesterday.

Northern Dynasty in talks to settle EPA litigation, shares hit 5-year high

US couple could face trial over gold bars missing from 18th Century sunken ship

China Rare Earth Group says executive moves at listed unit won’t affect operations

Lupaka Gold skyrockets on arbitration win against Peru

Gold price retreats to one-week low on US tariff delay

Torngat Metals’ rare earths project revival aims to create ‘a new industry in Canada’ CEO says

Critical minerals to top Modi’s agenda in five-nation tour

Japan to test mine seabed mud for rare earths

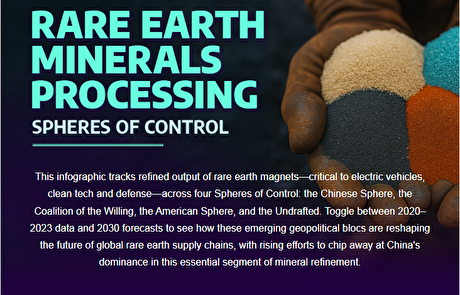

Infographic: Who controls rare earth processing?

Copper output at Ivanhoe’s Congo mine jumps in second quarter

Gold ETFs drew largest inflow in five years during first half of 2025, WGC says

Glencore to sell Philippine copper smelter to Villar family

Mali to sell $107M in gold from Barrick to fund mine restart

EU prepares to stockpile critical minerals in case of war: FT

Dundee receives environmental OK for underground gold project in Ecuador

China’s mining investment sets new record

Royal Gold to acquire Sandstorm, Horizon in $3.7B deal

Copper price soars to record as Trump announces 50% tariff

CHART: Nickel overtakes lithium as most valuable EV battery metal as prices slump

Gold ETFs drew largest inflow in five years during first half of 2025, WGC says

Mali to sell $107M in gold from Barrick to fund mine restart

EU prepares to stockpile critical minerals in case of war: FT

Dundee receives environmental OK for underground gold project in Ecuador

China’s mining investment sets new record

Royal Gold to acquire Sandstorm, Horizon in $3.7B deal

Copper price soars to record as Trump announces 50% tariff

CHART: Nickel overtakes lithium as most valuable EV battery metal as prices slump

Summit Royalty to go public in deal with Eagle Royalties