Equinox Gold kicks off ore processing at Valentine mine

According to me-metals cited from mining.com, “I am pleased to announce that our Valentine gold mine has begun processing ore through its 2.5-million-tonne-per-annum facility,” chief executive officer Darren Hallsaid on Thursday.

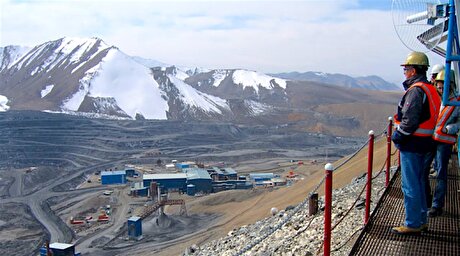

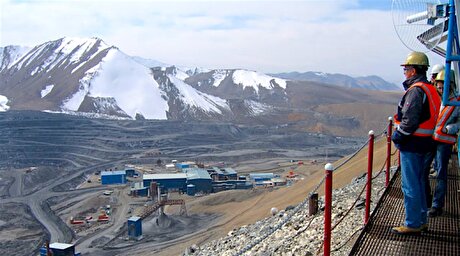

The Vancouver-based miner expects to ramp-up to nameplate capacity in the second quarter of 2026. At that point, Valentine is projected to produce 175,000 to 200,000 ounces of gold annually for the first 12 years of its 14-year reserve life.

BMO analysts noted that while the progress reported at the mine aligns with expectations for August, they anticipate an annual output of 171,000 ounces in 2026 and 202,000 ounces in 2027.

When fully operational, Valentine will be the largest gold mine in Atlantic Canada and a major economic driver for Newfoundland and Labrador. It marks the second mine Equinox has brought online, following the start-up of its Greenstone project in Ontario, which entered commercial production in November 2024. Equinox gained control of Valentine through its recent acquisition of Calibre Mining.

Valentine hosts proven and probable reserves of 2.7 million ounces grading 1.62 g/t gold. It also contains 1.3 million ounces in measured and indicated resources grading 1.45 g/t, along with an inferred resource of 1.1 million ounces grading 1.65 g/t. Equinox says the project could anchor a new gold district in central Newfoundland.

New blood

To support the transition at Greenstone, Equinox is expanding its leadership team. Bryan Wilson will join as vice-president of operations on September 3, bringing more than 37 years of open-pit and underground mining experience. Roger Souckey has been appointed director of external relations, while Daniella Dimitrov will take on the role of executive vice-president of sustainability, people and strategy.

Dimitrov, who has more than 25 years of experience in strategy, finance and governance, is expected to strengthen the company’s push to become a top-tier gold producer anchored by long-life Canadian mines.

Hall said Equinox is entering “a pivotal phase of growth,” with both Valentine and Greenstone set to drive a sharp increase in production and cash flow in the year ahead.

Energy Fuels soars on Vulcan Elements partnership

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Ukraine launches tender for major lithium deposit

KoBold Metals granted lithium exploration rights in Congo

Freeport Indonesia to wrap up Gresik plant repairs by early September

Critical Metals signs agreement to supply rare earth to US government-funded facility

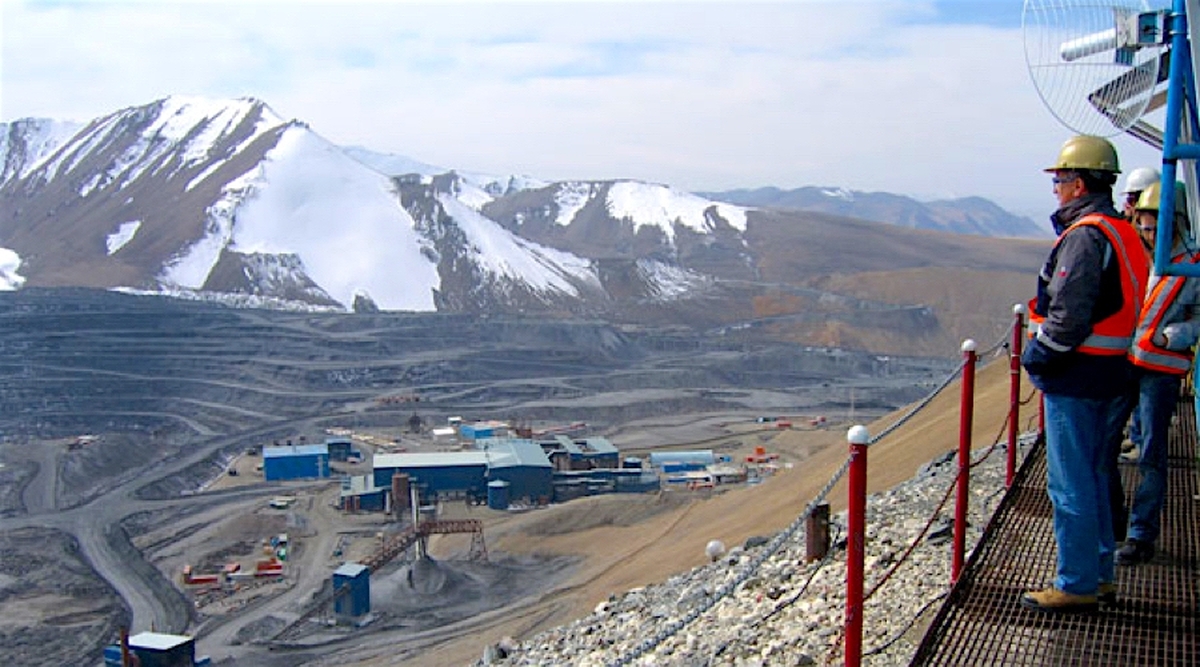

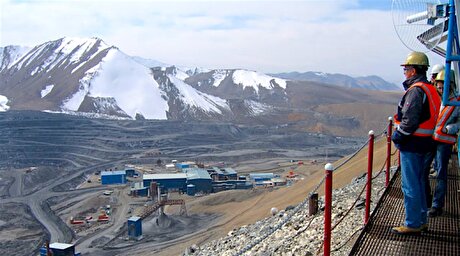

Kyrgyzstan kicks off underground gold mining at Kumtor

Equinox Gold kicks off ore processing at Valentine mine

India considers easing restrictions on gold in pension funds

Luca Mining expands Tahuehueto mine with Fresnillo land deal

Kyrgyzstan kicks off underground gold mining at Kumtor

Ukraine launches tender for major lithium deposit

KoBold Metals granted lithium exploration rights in Congo

Freeport Indonesia to wrap up Gresik plant repairs by early September

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

India considers easing restrictions on gold in pension funds

Luca Mining expands Tahuehueto mine with Fresnillo land deal

Kyrgyzstan kicks off underground gold mining at Kumtor

Ukraine launches tender for major lithium deposit

Freeport Indonesia to wrap up Gresik plant repairs by early September

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility