Critical Metals, Ucore ink 10-year offtake deal to supply rare earths to US plant

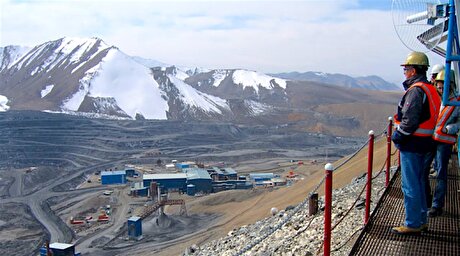

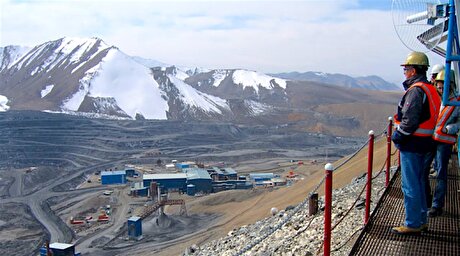

According to me-metals cited from mining.com, Under the terms, Critical Metals will supply up to 10,000 tonnes of rare earth concentrates annually from its Tanbreez project in Greenland, ranked one of the biggest rare earth projects in the world.

The deal connects the massive rare earth project with Ucore’s Department of Defense (DoD) funded processing facility in Alexandria’s England Airpark—a key step toward reducing US reliance on foreign sources for heavy rare earths.

The concentrate, Critical Metals said, will be providing critical feedstock for high-purity rare earth oxides used in advanced tech and defense applications.

After hydro-metallurgical processing, the concentrate will be used as feedstock for Ucore’s rare earth element processing facility, which broke ground in May, in Alexandria, Louisiana and at Ucore’s facility in Kingston, Ontario.

The Louisiana facility will produce high-purity rare earth oxides from mixed rare earth carbonates or oxides, which Critical Metals expects to produce at Tanbreez. It aims to produce 2,000 tonnes per annum of oxides next year, with the capacity expected to be scaled up to 7,500 tonnes in 2028.

“Critical Metals’ Tanbreez offers tremendous opportunities for Ucore given the significant concentration of heavy rare earths it contains, which are essential for our processing facility in Louisiana, and our downstream partners,” Ucore CEO Pat Ryan said in a statement.

“Both Critical Metals and Ucore share a vision to lessen China’s grip of the rare earth ecosystem in the West, and we look forward to our partnership, positioning us both to meet the growing demand for rare earths while addressing national security challenges.”

“Securing this offtake provides Critical Metals both with our first buyer and the flexibility to supply other US-based rare earth facilities in the future, given the immense size of our Tanbreez deposit,” Critical Metals’ CEO Tony Sage added.

The deal was brokered by GreenMet, a Washington, DC-based advisory firm acting as a conduit between private capital, government and critical minerals industry.

In an email to MINING.com, GreenMet CEO Drew Horn called the agreement “a landmark achievement and a powerful example of strategic partnerships building a resilient, domestic supply chain.”

source: mining.com

KoBold Metals granted lithium exploration rights in Congo

Freeport Indonesia to wrap up Gresik plant repairs by early September

Kyrgyzstan kicks off underground gold mining at Kumtor

Luca Mining expands Tahuehueto mine with Fresnillo land deal

Equinox Gold kicks off ore processing at Valentine mine

India considers easing restrictions on gold in pension funds

Critical Metals, Ucore ink 10-year offtake deal to supply rare earths to US plant

Critical Metals, Ucore ink 10-year offtake deal to supply rare earths to US plant

Equinox Gold kicks off ore processing at Valentine mine

India considers easing restrictions on gold in pension funds

Luca Mining expands Tahuehueto mine with Fresnillo land deal

Kyrgyzstan kicks off underground gold mining at Kumtor

Ukraine launches tender for major lithium deposit

KoBold Metals granted lithium exploration rights in Congo