Viewpoint: Weak Chinese demand to weigh on Supramaxes

Supramaxes primarily transport grains, coal and minor bulk commodities, such as steel, nickel ore, forest products and bauxite.

Chinese demand for grain is expected to be subdued in 2020, as the country's hog herd recovers from an African swine fever outbreak that led to the destruction of 32pc of the herd this year.

"It will take years for the Chinese pig population to return to the same size as before the cull, and even then, lowering the soya content in pig's feed will have lasting consequences on these trades," shipping association Bimco said.

This uncertainty surrounding China's pig population has caused Brazilian farmers to hesitate to expand planting, according to the US Department of Agriculture's foreign agricultural service report from October, as there likely would not be enough demand to meet increased supply.

Muted Chinese demand for grains because of the swine fever outbreak played a role in pulling Supramax rates down this year. The US Gulf coast-east coast India Supramax petroleum coke freight rate has averaged $36.46/metric tonne so far in 2019, compared with $37.07/t in 2018, according to Argus assessments. Chinese soybean imports fell by roughly 11pc in the first seven months of the year compared with the same period in 2018, shipping agency Biehl said.

Supply outpacing demand

On the supply side, dry bulk newbuild deliveries hit a five-year high in 2019, with 36mn dwt of new bulkers being delivered, according to Bimco. This above-average fleet growth will likely put downward pressure on bulker rates in 2020, as demand growth is not expected to be as high.

Although the vast majority of the dry bulk fleet expansion will not occur in the Supramax segment, increased tonnage supply of larger bulkers, such as Capesizes, puts downward pressure on Supramax rates. This was evident following the 25 January Brumadinho dam collapse, which shut down large portions of Brazilian iron ore producer Vale's production capacity, limiting iron ore exports from the region. This, in turn, led to a surplus of available Capesize tonnage and pulled dry bulk rates across the market to depressed levels. On 6 February, the US Gulf coast-east coast India Supramax petroleum coke freight rate fell to a 2019 low of $29.75/t, the lowest since 19 June 2017, according to Argus assessments.

The International Maritime Organization 0.5pc sulphur cap will provide some support for rates early in 2020, as bulkers will see a short-term tightening of supply because of ships having scrubbers installed into the first quarter of 2020.

Trade war progress

One potential source of upward pressure for Supramax rates is that Chinese demand for US bulker shipments is expected to rise because of recent progress made toward a trade deal between the two countries. The US and China announced an interim agreement on 13 December, and Beijing has said it will increase its imports of US soybeans and other farm products, although the exact volumes are unknown and the deal is not finalized.

The trade dispute between the two countries weighed on dry bulk rates and shipment volumes from the US to China. Total US-China Supramax shipments fell to roughly 3.08mn deadweight tonnes (dwt) in the first 11 months of 2019 from roughly 5.45mn dwt in the same period in 2018, according to research firm VesselsValue.

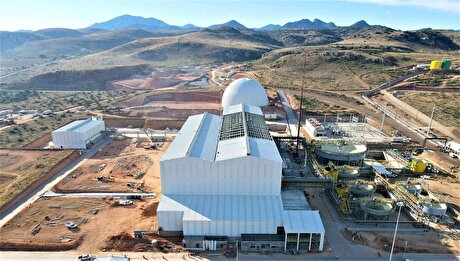

Electra converts debt, launches $30M raise to jumpstart stalled cobalt refinery

Barrick’s Reko Diq in line for $410M ADB backing

Trump weighs using $2 billion in CHIPS Act funding for critical minerals

Pan American locks in $2.1B takeover of MAG Silver

Codelco cuts 2025 copper forecast after El Teniente mine collapse

SQM boosts lithium supply plans as prices flick higher

US adds copper, potash, silicon in critical minerals list shake-up

Viridis unveils 200Mt initial reserve for Brazil rare earth project

Gold price gains 1% as Powell gives dovish signal

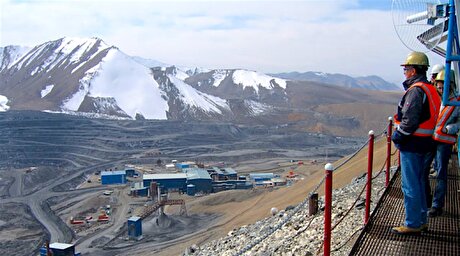

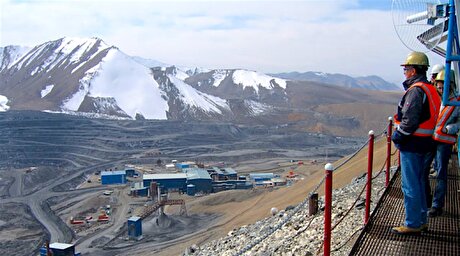

Kyrgyzstan kicks off underground gold mining at Kumtor

Kyrgyzstan kicks off underground gold mining at Kumtor

KoBold Metals granted lithium exploration rights in Congo

Freeport Indonesia to wrap up Gresik plant repairs by early September

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Kyrgyzstan kicks off underground gold mining at Kumtor

Freeport Indonesia to wrap up Gresik plant repairs by early September

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Silver price touches $39 as market weighs rate cut outlook