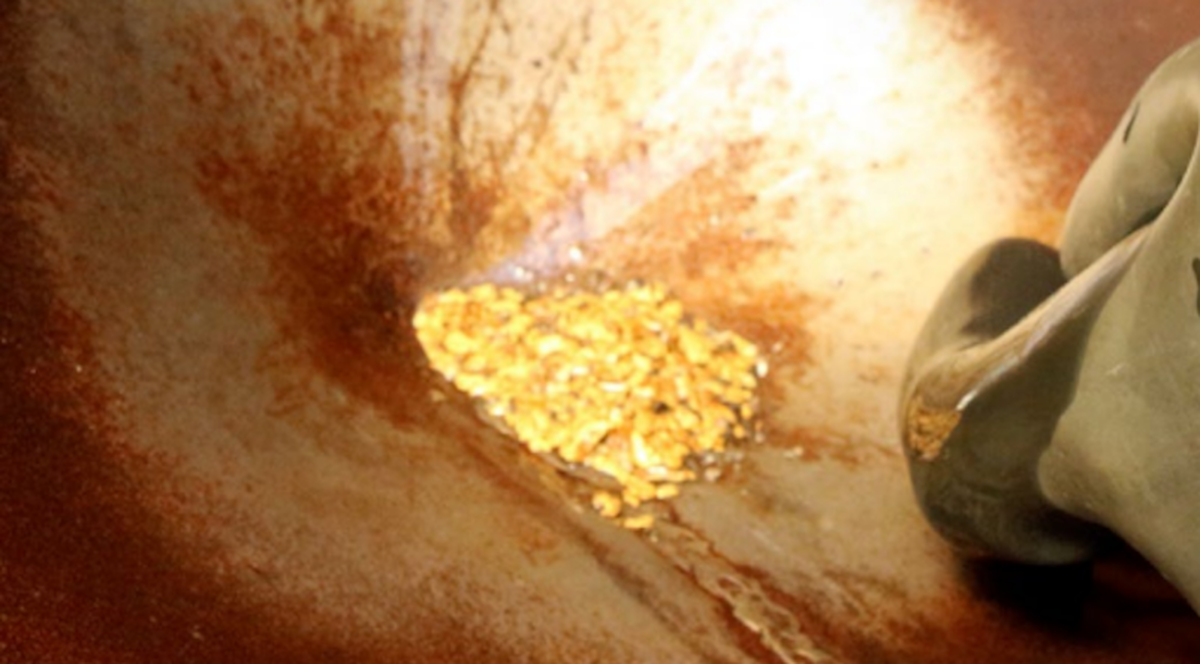

Chinese gold miner scours globe for takeover targets

According to me-metals cited from mining.com, “There are so many projects on the market that owners are willing to sell,” Lydia Yang, chief executive officer of Chifeng Jilong Gold Mining Co., said in an online interview Thursday from Beijing. She noted there seemed to be more takeover opportunities this year than previously.

Known as Chifeng Gold, the miner has been rapidly expanding production both at home and overseas and is the nation’s largest producer that’s not state owned. Combined annual output of the precious metal from its five mines in China and one apiece in Ghana — bought in 2021 — and Laos has surged from around 2 tons in 2019 to 15.2 tons last year.

Miners in China — the world’s biggest gold producer — are increasingly vying for deals overseas against international heavyweights, spurred by bullion’s record-breaking rally over the past three years. As part of its global push, Chifeng Gold listed on the Hong Kong Stock Exchange in March after raising HK$2.82 billion ($361 million). Its shares have since surged 80%.

Hong Kong provides direct access to capital, “so that when we identify attractive investment opportunities, we can move quickly,” Yang said.

With global production of gold flat-lining near 2018 levels and greenfield exploration lagging, some miners with aging assets see M&A as the best avenue to pursue growth. Along with China’s CMOC Group, Australia’s Northern Star Resources Ltd. and South Africa’s Gold Fields Ltd. have been among the most recent buyers of smaller companies.

In 2024, the value of precious metal deals completed and proposed grew almost a quarter and made up more than half of the total deals inked across the wider metals sector, according to Bloomberg calculations.

To be sure, Chifeng is taking a measured approach to M&A amid heightened immediate price volatility. Gold has fallen around 8% since hitting a record of around $3,500 an ounce last month, as optimism over improving US-China relations dented its haven value.

That means Chifeng — which Yang said had no plans of diversifying into other resources — will be judicious about takeover deals in the immediate future.

“When prices are this high, it’s hard to pin down a valuation, as sellers have rising expectations,” she said. “It may be better to wait until things stabilize.”

source: mining.com

Locksley Resources forms US alliances to establish domestic antimony supply chain

Critical Metals, Ucore ink 10-year offtake deal to supply rare earths to US plant

Equinox Gold kicks off ore processing at Valentine mine

India considers easing restrictions on gold in pension funds