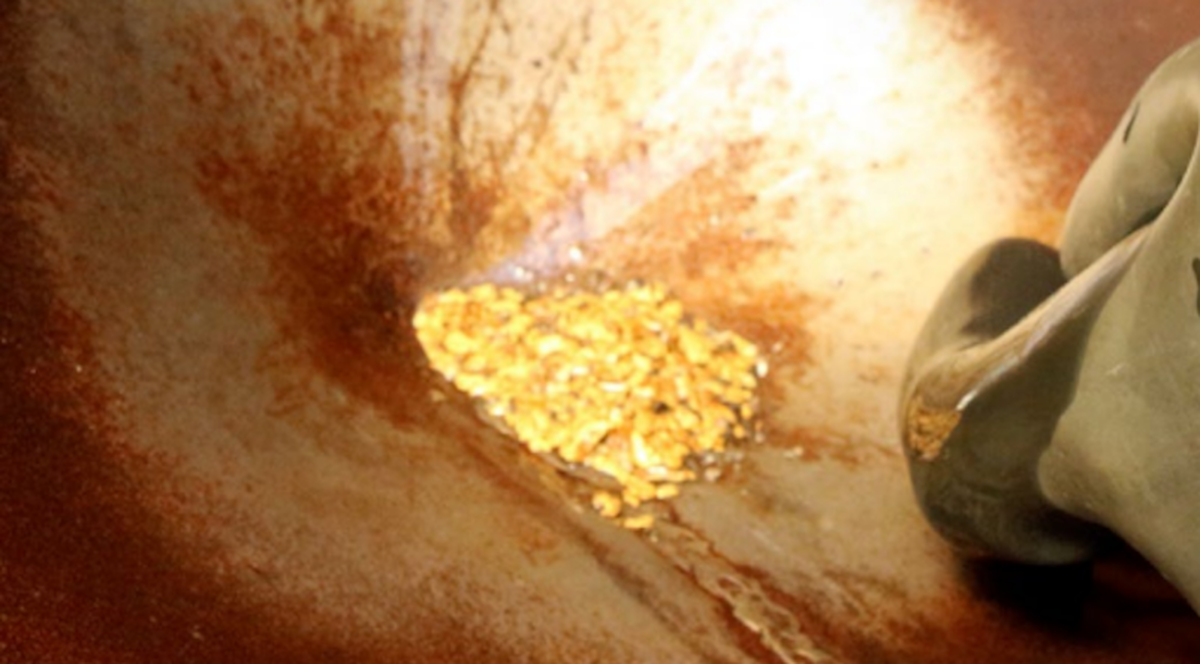

Greatland Gold targets $33M in ASX dual listing push

According to me-metals cited from mining.com, The Western Australian gold and copper miner, backed by Newmont Corporation (NYSE: NEM) and Andrew Forrest’s Wyloo Metals, aims to broaden its investor base and accelerate development in the Paterson province. Bank of America, Barrenjoey and Canaccord Genuity are managing the IPO.

While the capital raise is relatively modest, it forms part of a sweeping A$339 million restructuring announced in April, designed to reposition the company. This includes a A$14 million retail offer in the UK and the establishment of a new Australian parent entity, Greatland Resources, which is slated to list on the ASX on June 24.

Over 66.7 million shares will be offered, with proceeds earmarked for working capital across Greatland’s flagship assets, which include Telfer, Havieron and nearby tenements acquired from Newmont last year. These assets are central to the company’s strategy to establish a large-scale mining and processing hub in the mineral-rich region.

Since taking control of Telfer, Greatland has delivered its strongest production performance in years. The company expects to produce between 196,000 and 210,000 ounces of gold in FY25, with all-in sustaining costs forecast between $2,100 and $2,250 per ounce. A short-term production target has been set at 280,000 to 320,000 ounces annually for the first two years, creating a runway to first ore at Havieron.

Newmont, Greatland’s largest shareholder with a 20.4% stake, is reportedly considering a partial sell-down. It remains unclear whether it will use the IPO to divest, or whether Wyloo, which holds a 8.6% interest through a A$120 million investment in 2022, will exercise its first right of refusal or increase its position. Wyloo also holds the option to acquire half of Newmont’s stake.

Greatland Gold is currently valued at £1.8 billion ($2.4 billion) on the London Stock Exchange.

source: mining.com

Locksley Resources forms US alliances to establish domestic antimony supply chain

Critical Metals, Ucore ink 10-year offtake deal to supply rare earths to US plant

Equinox Gold kicks off ore processing at Valentine mine

India considers easing restrictions on gold in pension funds