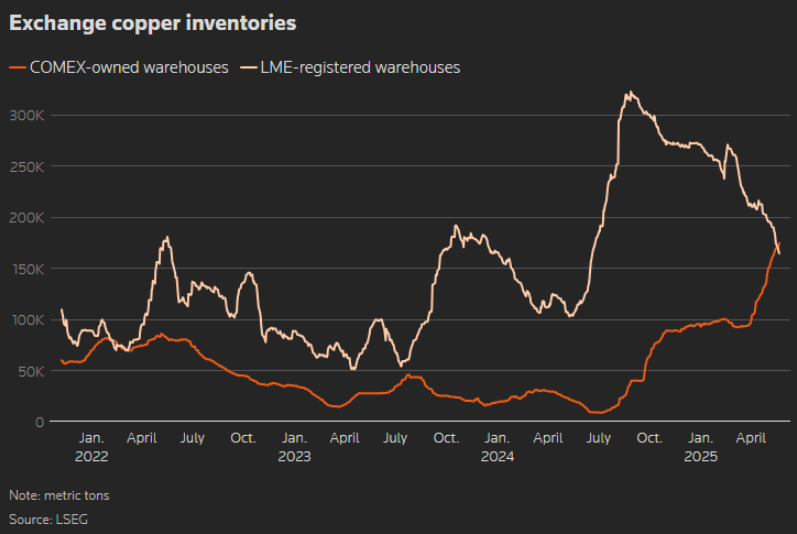

COMEX copper stocks exceed LME for first time since 2022

According to me-metals cited from mining.com, Inventories in warehouses owned by the US COMEX exchange have surged to 174,607 metric tons, marking their highest level since 2018 with an 87% increase since the end of February.

In contrast, LME-registered warehouses have seen persistent outflows, with stocks falling to 164,725 metric tons, a 37% decline since the end of February.

This global reshuffling of copper inventories follows a directive by US President Donald Trump in February to launch an investigation into possible tariffs on copper imports to rebuild US production of copper critical to electric vehicles, power transmission and construction.

Currently, the premium on COMEX copper over the LME price, stands at $683 per ton. In March, this spread widened to a record $1,572 per ton, highlighting the growing divergence between the two markets.

“That price premium has attracted metal to the US, so it results in pressure and draws from other exchanges,” said Alastair Munro at broker Marex.

Meanwhile, in the LME system, the spread between the cash against the three-month copper contract remains at a premium, indicating some tightness for the nearby supply due to the outflows.

The drawdown isn’t limited to Western exchanges. China, the world’s top copper consumer, is also seeing inventory declines. Stocks in Shanghai Futures Exchange-monitored warehouses fell 9% this week to 98,671 metric tons.

source: mining.com

Locksley Resources forms US alliances to establish domestic antimony supply chain

Critical Metals, Ucore ink 10-year offtake deal to supply rare earths to US plant

Equinox Gold kicks off ore processing at Valentine mine

India considers easing restrictions on gold in pension funds